We use cookies for a variety of purposes, such as website functionality and helping target our marketing activities. Some functional cookies are required in order to visit this website.

You can withdraw your consent at any time on ourCookie同意页。

Configure your cookie settings and confirm to save your settings. You can withdraw or change your consent at any time on ourCookie同意页。Press release -Veldhoven,荷兰,2022年4月20日

如今,ASML Holding NV(ASML)已发布其2022年第一季度结果。

第一季度净销售额为35亿欧元,毛利率为49.0%,净收入为6.95亿欧元

Q1净预订为70亿欧元2

ASML预计净销售额为222亿欧元至53亿欧元,毛利率在49%至50%之间

| (Figures in millions of euros unless otherwise indicated) | Q4 2021 | Q1 2022 |

|---|---|---|

| 净销售 | 4,986 | 3,534 |

| 。。。of which Installed Base Management sales1 | 1,522 | 1,247 |

| 新的光刻系统销售(单位) | 72 | 59 |

| Used lithography systems sold (units) | 10 | 3 |

| Net bookings2 | 7,050 | 6,977 |

| Gross profit | 2,701 | 1,731 |

| Gross margin (%) | 54.2 | 49.0 |

| 净利 | 1,774 | 695 |

| EPS(基本;以欧元为单位) | 4.39 | 1。73 |

| End-quarter cash and cash equivalents and short-term investments | 7,590 | 4,723 |

(1) Installed Base Management sales equals our net service and field option sales.

(2) Our systems net bookings include all system sales orders for which written authorizations have been accepted.

Numbers have been rounded for readers' convenience. A complete summary of US GAAP Consolidated Statements of Operations is published onwww.porsat.com。

首席执行官声明和前景

“我们的第一季度净销售额为35亿欧元,这是我们指导的高端。毛利率为49.0%,是指导性的。我们的第一季度净预订额为70亿欧元,包括2.5欧元。从0.33 NA和0.55 NA EUV系统以及非常强大的DUV预订,反映了对高级和成熟节点的持续需求。

"We continue to see that the demand for our systems is higher than our current production capacity. We accommodate our customers through offering high-productivity upgrades and reducing cycle time in our factories, and we continue to offer a fast shipment process. In addition, we are actively working to significantly expand capacity together with our supply chain partners. In light of the demand and our plans to increase capacity, we expect to revisit our scenarios for 2025 and growth opportunities beyond. We plan to communicate updates in the second half of the year.

"ASML expects second-quarter net sales between €5.1 billion and €5.3 billion with a gross margin between 49% and 50%. ASML expects R&D costs of around €790 million and SG&A costs of around €220 million. For the full year, we continue to expect a revenue growth of around 20%," said ASML President and Chief Executive Officer Peter Wennink.

产品和业务亮点

We received multiple orders this quarter for our High-NA EXE:5200 systems (EUV 0.55 NA) from both Logic and Memory customers.

In our Applications business, we shipped our first eScan460 system, which is our next-generation single-beam inspection system, with higher resolution and 50% faster throughput than eScan430.

Update share buyback program

作为其财务政策的一部分,将超额现金通过日益增加的股息和股票回购向其股东退还给股东,ASML执行了一项股票回购计划,该计划于2021年7月22日开始,并将在2023年12月31日之前关闭。,ASML打算回购高达90亿欧元的股票,我们预计将总共有450万股股票来涵盖员工股票计划。ASML打算取消回购的剩余股份。在第一季度,我们根据当前计划购买了价值约21亿欧元的股票。

股票回购计划将在股东年度股东大会(AGM)授予的现有权力的局限性范围内执行,并于2021年4月29日,并由未来AGMS授予的权力。股票回购计划可以随时暂停,修改或中止。该计划下的所有交易将每周在ASML的网站(www.porsat.com/investors)上发布。万博亚洲ios手机客户端

季度视频采访和投资者电话

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the 2022 first-quarter results and outlook for 2022. This video and the transcript can be viewed onwww.porsat.com。

投资者呼吁投资者和媒体,首席执行官彼得·温宁克(Pe万博亚洲ios手机客户端ter Wennink)和首席财务官罗杰·达森(CFO Roger Dassen)将于2022年4月20日在15:00中欧时间 /美国东部时间09:00举办。详细信息可以在Q1 2022结果页面。

manbext手机官网

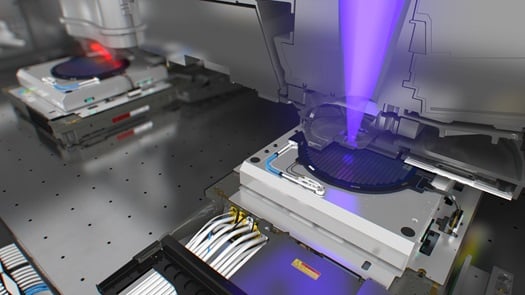

ASML是半导体行业的主要供应商。该公司为万博苹果手机客户端芯片制造商提供硬件,软件和服务,以大规模生产集成电路(微芯片)的模式。ASML与合作伙伴一起推动了更实惠,更强大,更节能的微芯片的进步。ASML使开创性的技术能够解决人类最艰巨的挑战,例如在医万博manbetx官网登录疗保健,能源使用和保护,流动性和农业中。ASML是一家跨国公司,总部位于荷兰Veldho万博苹果手机客户端ven,在欧洲,美国和亚洲设有办事处。每天,ASML的33,100名员工(FTE)挑战现状,并将技术推向新的限制。万博manbetx官网登录ASML在符号ASML下以Euronext Amsterdam和Nasdaq在EuroNext上进行交易。发现ASML - 我们的产品,技术和职业机会 -万博manbetx官网登录www.porsat.com。

US GAAP Financial Reporting

ASML的季度收益发行和年度报告的主要会计标准是美国GAAP,这是美国普遍接受的会计原则。美国GAAP合并的运营声明,现金流量的合并陈述和合并资产负债表可在www.porsat.com。

The consolidated balance sheets of ASML Holding N.V. as of April 3, 2022, the related consolidated statements of operations and consolidated statements of cash flows for the quarter and three months ended April 3, 2022 as presented in this press release are unaudited.

受监管的信息

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Forward looking statements

本文档包含前瞻性的陈述,包括有关预期趋势的陈述,包括最终市场和技术行业和商业环境趋势的趋势,业务成本上升,前景和预期财务业绩,包括预期的净销售额,毛利率,R&D万博manbetx官网登录成本,SG&A成本以及估计的年度有效税率,预订,预期净销售额增长,全年2022年期望,包括收入,货运和对EUV,DUV,IBM的期望以及市场细分市场的期望,包括2021年投资者日的报表,包括收入以及2025年的毛利率和2025年以后的增长机会,预期的年收入增长率为2020 - 2030年,我们的计划重新审视了在2021年投资者日提出的这些期望,预期的收入确认,包括估计收入的估计值在装运后的期间,预期的货物,计划和策略,包括增加C的计划能够建立额外的洁净室,客户需求和计划以满足日益增长的需求,股息和股票回购和财务政策的计划,包括有关2021-2023股票回购计划的陈述,包括打算回购的股票金额,根据该计划,ESG策略的改进和其他非历史性陈述。您通常可以通过使用诸如“可能”,“愿意”,“应该”,“项目”,“相信”,“预期”,“期望”,“计划”,“估算”之类的单词来识别这些陈述。“,“预测”,“潜在”,“打算”,“继续”,“目标”,“未来”,“进度”,“目标”和这些单词或可比较的单词的变化。这些陈述不是历史事实,而是基于当前的期望,估计,假设和预测,对我们的业务以及我们未来的财务结果,读者不应过分依赖它们。前瞻性陈述不能保证未来的表现,并且涉及许多已知和未知的风险和不确定性。These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors, the impact of general economic conditions on consumer confidence and demand for our customers’ products, performance of our systems, the impact of the COVID-19 outbreak and measures taken to contain it on us, our suppliers, the global economy and financial markets, the impact of the Russian military actions in the Ukraine and measures taken in response on the global economy and global financial markets and other factors that may impact ASML’s financial results, including customer demand and ASML’s ability to obtain parts and components for its products and otherwise meet demand, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products, production capacity and our ability to increase capacity to meet demand, the impact of inflation, the number and timing of systems ordered, shipped and recognized in revenue, and the risk of order cancellation or push out, supply chain capacity and logistics and constraints on our ability to produce systems to meet demand, trends in the semi-conductor industry, our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation, availability of raw materials, critical manufacturing equipment and qualified employees, trade environment, import/export and national security regulations and orders and their impact on us, changes in exchange and tax rates, available liquidity and liquidity requirements, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, results of the share repurchase programs and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F for the year ended December 31, 2021 and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We undertake no obligation to update any forward-looking statements after the date of this report or to conform such statements to actual results or revised expectations, except as required by law.

联系信息

- Monique Mols

- 媒体关系主管

- +31 652 844 418

- Ryan Young

- 媒体关系经理,美国

- +1 4802058659

- 凯伦·洛(Karen Lo)

- 台湾传播

- +886 939788635

- 跳过米勒

- Head Investor Relations Worldwide

- +1 480 235 0934

- Marcel Kemp

- 欧洲首席投资者关系

- +31 40 268 6494

- Peter Cheang

- 首席投资者关系亚洲

- +886 3 6596771