财务策略

我们的长期财务战略和增长期望

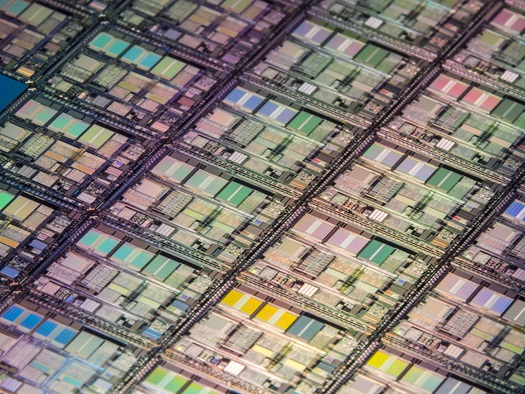

光刻是半导体行业的核心。在过去的30年中,我们利用了我们独特的经验和创新平衡,随着这个不断发展的行业的需求而发展,并为所有利益相关者建立了强大的增值业务。

我们拥有正确的工具来执行我们的长期财务战略,并希望在未来几年实现持续的可持续增长。

大趋势=可观的增长

万博manbetx官网登录技术正在快速变化。大约175个数据将在2025年每年创建。

如果没有半导体行业的不懈努力来提高计算机芯片的性能,同时降低了成本,就无法实现这一数据量。

尽管世界上最先进的逻辑和记忆芯片正在为人工智能,大数据和汽车技术的高端趋势提供动力,但简单,低成本的芯片正在整合日常技术中的传感能力,以创建庞大的事物互联网。万博manbetx官网登录

简而言之,在未来几年中,全球半导体市场将继续成倍增长。

这转化为在所有细分市场中,尤其是在领先的节点中的全球晶圆厂容量的增长。这为ASML提供了长期的增长机会,因为我们继续满足半导体行业对更高生产率,较低成本和更简单的芯片制作过程的需求。

根据不同的市场情况,我们有机会将2025年的年收入增长到240亿至300亿欧元。

加快EUV

收缩是主要驱动力,支持创新并提供半导体行业的长期增长。

但是,该行业需要适当的工具来成本效率地生产芯片技术,尤其是随着芯片功能继续缩小。万博manbetx官网登录

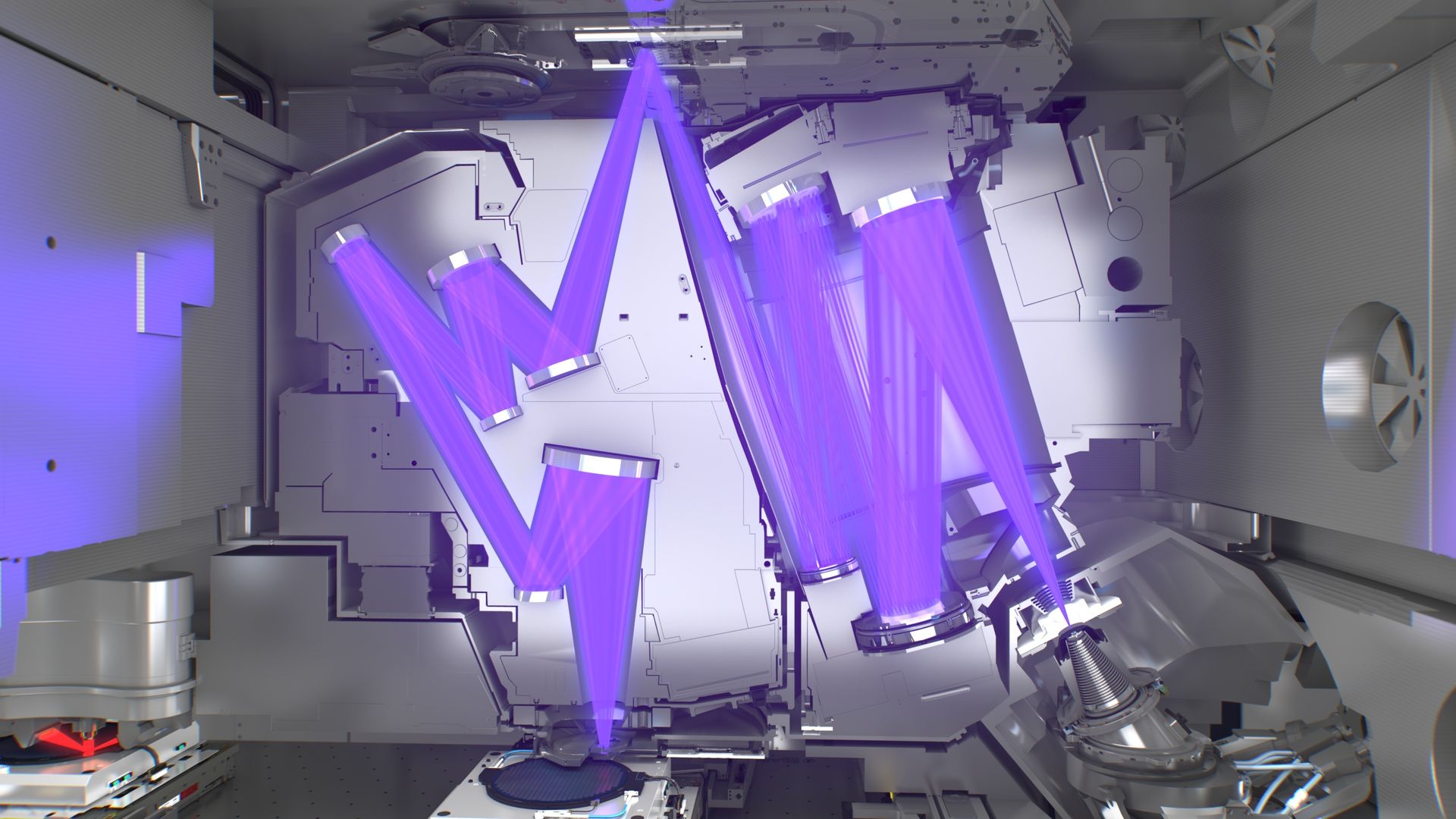

从深紫外线(DUV)至极端紫外线(EUV)与复杂的多理解流程相比,Light简化了芯片制造过程,并降低了整体成本。

ASML开创了EUV光刻。由于我们的机器实现了更高的分辨率,因此芯片制造商现在可以生产更小,更快,更强大的芯片,同时保持成本。

摩尔探索

EUV工业化只是我们旅程下一阶段的开始。我们的产品组合与行业趋势和客户的详细产品路线图保持一致,这需要启用光刻的收缩,超过了未来十年。

ASML将继续探索许多其他领域的机会,这些机会为我们的客户和企业提供独特的价值驱动力。

专注于并购

在过去的几年中,我们已经完成了几项战略和集中的合并和收购,以进一步支持我们作为公司的增长和技术进步。万博苹果手机客户端

2001年,我们收购了硅谷集团,该集团在美国康涅狄格州威尔顿的网站现在是一个主要的研发和制造中心。

2007年,我们收购了Brion,这是一家美国专门用于集成电路的计万博苹果手机客户端算光刻的公司。此后,Brion的投资组合已成为我们整体光刻产品策略的基石。

;

;

;

;

;

;

;

;

;

;