我们将cookie用于各种目的,例如网站功能并帮助针对我们的营销活动。为了访问此网站,需要一些功能性饼干。

You can withdraw your consent at any time on ourcookie consent page。

配置您的cookie设置并确认以保存您的设置。您可以随时撤回或更改您的同意cookie consent page。Press release -Veldhoven,荷兰,2022年11月10日

At the Investor Day meeting on November 11, ASML Holding N.V. (ASML) will update its investors and key stakeholders at its headquarters in Veldhoven, the Netherlands as well as online, about its updated view on demand outlook. President & CEO Peter Wennink and Executive Vice President & CFO Roger Dassen will discuss ASML's long-term strategy, megatrends, demand, capacity plans and business model to support the company’s future growth.

Updated scenarios with opportunities to support ASML's future growth

While the current macro environment creates near-term uncertainties, we expect longer-term demand and capacity showing healthy growth.

预计扩大的应用领域和行业创新将继续推动整个半导体市场的增长。

Strong growth rates across markets, continued innovation, more foundry competition and technological sovereignty drive an increased demand at advanced and mature nodes, which is expected to require wafer capacity additions.

我们计划调整满足未来需求的能力,为周期性做准备,同时与所有利益相关者共享风险并公平地奖励。

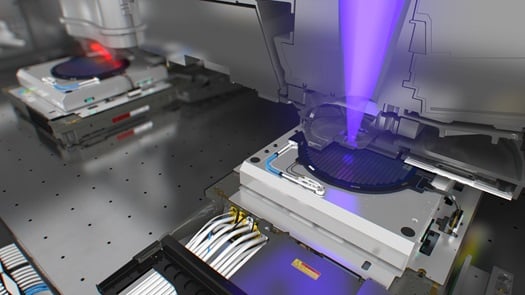

We plan to increase our annual capacity to 90 EUV and 600 DUV systems (2025-2026), while also ramping High-NA EUV capacity to 20 systems (2027-2028).

我们对技术领导力的持续投资创造了巨大的股东价值。万博manbetx官网登录半导体终端市场的增长以及对未来节点的光刻强度的提高为我们的产品和服务增添了需求。

These new developments and plans have resulted in updated scenarios for our future growth, compared to the previous Investor Day in September 2021.

Based on different market scenarios, we expect a substantial growth opportunity to achieve the following:

2025年:年收入约300亿至400亿欧元,毛利率约为54%至56%

2030: annual revenue between approximately €44 billion and €60 billion with a gross margin between approximately 56% and 60%

新的股票回购计划

We expect to continue to return significant amounts of cash to our shareholders through a combination of growing dividends and share buybacks. ASML announces a new share buyback program, effective November 11 and to be executed by December 31, 2025. We intend to repurchase shares up to an amount of €12.0 billion, of which we expect a total of up to 2 million shares will be used to cover employee share plans. We intend to cancel the remainder of the shares repurchased.

股票回购计划将在AGM于2022年4月29日授予的现有当局的局限性以及未来AGM授予的权力的限制范围内执行。股票回购计划可以随时暂停,修改或中止。该计划下的所有交易将发布ASML's websiteon a weekly basis.

Webcast and presentations

11月11日的投资者日计划从13:30到16:30 CET。可以在我们的网站上找到指向实时网络广播的链接(无需预注册)。演示文稿和录音将在此后提供website。

manbext手机官网

ASML is a leading supplier to the semiconductor industry. The company provides chipmakers with hardware, software and services to mass produce the patterns of integrated circuits (microchips). Together with its partners, ASML drives the advancement of more affordable, more powerful, more energy-efficient microchips. ASML enables groundbreaking technology to solve some of humanity's toughest challenges, such as in healthcare, energy use and conservation, mobility and agriculture. ASML is a multinational company headquartered in Veldhoven, the Netherlands, with offices across Europe, the US and Asia. Every day, ASML’s more than 37,500 employees (FTE) challenge the status quo and push technology to new limits. ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. Discover ASML – our products, technology and career opportunities – atwww.porsat.com。

Regulated information

本新闻稿包含内部信息,范围内的欧盟市场滥用法规第7(1)条的含义。

Forward Looking Statements

本文档和相关讨论包含1995年《美国私人证券诉讼改革法案》含义的陈述,包括有关预期趋势的陈述,包括最终市场的趋势以及技术行业和商业环境趋势,预期光刻万博manbetx官网登录半导体行业的增长和增长率和收入,资本强度前景,半导体终端市场的预期增长,晶圆需求和能力的预期增长以及额外的晶圆产能需求,预期的晶圆投资以及增加能力的计划,增长能力,预期的增长,光刻支出的增长,服务和升级增长的机会以及安装基础管理销售的预期增长,预计ASML及其供应商的容量和计划的预计增加了能力和产出以满足需求,预期的系统生产,2025年和2030年的更新模型,Outlook并预期,建模或潜在金融l结果,包括收入预测和年收入机会毛利率,研发成本,SG&A成本,资本支出,现金转换周期和2025年和2030年的年度有效税率以及为我们的预期,建模或潜在金额以及我们的其他假设以及我们的其他假设的假设以及我们的其他假设商业和财务模型,半导体终端市场的预期趋势以及长期增长机会,需求和需求驱动因素,半导体行业的预期增长,包括需求增长和未来几年的预期资本支出,技术主权和铸造厂的影响万博manbetx官网登录with respect to dividends and share buybacks and dividend policy, including expectation of growing dividends and buybacks and statements with respect to ASML’s new buyback plan, energy generation and consumption trends and the drive toward energy efficiency, increasing technological sovereignty across the world, including specific goals of countries across the world, increasing competition in the foundry business and other non-historical statements. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "target", "future", "progress", "goal" and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve a number of substantial known and unknown risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions, product demand and semiconductor equipment industry capacity, worldwide demand and manufacturing capacity utilization for semiconductors, the impact of general economic conditions on consumer confidence and demand and capacity for our customers’ products, performance of our systems, the impact of the COVID-19 outbreak and measures taken to contain it on us, our suppliers, the global economy and financial markets, the impact of the Russian military actions in the Ukraine and measures taken in response on the global economy and global financial markets and other factors that may impact ASML’s financial results, including customer demand and ASML’s ability to obtain parts and components for its products and otherwise meet demand, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products, risks relating to execution of technology roadmaps, demand and production capacity and our and our supplier’s ability to increase capacity to meet demand, the impact of inflation and any recession, investments in capacity and lithography spend, our ability to meet the goals and expectations in our business and financial models and whether the assumptions underlying our models prove to be reasonable and accurate, the number and timing of systems ordered, shipped and recognized in revenue, and the risk of order cancellation or push out, supply chain capacity and constraints and logistics and constraints on our ability to produce systems to meet demand, our ability to increase capacity including our infrastructure and workforce, our ability to control costs and maintain and improve gross margin and competitive position, trends in the semiconductor industry, our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation, availability of raw materials, critical manufacturing equipment and qualified employees, trade environment, geopolitical risks and impact on our business, import/export and national security regulations and orders and their impact on us including the impact of new U.S. export regulations, changes in exchange and tax rates, available liquidity and liquidity requirements, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, results of our share repurchase program and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F for the year ended December 31, 2021 and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We undertake no obligation to update any forward-looking statements after the date of this report or to conform such statements to actual results or revised expectations, except as required by law.

Contact information

- Monique Mols

- 媒体关系主管

- +31 652 844 418

- Ryan Young

- 媒体关系经理,美国

- +1 4802058659

- 凯伦·洛(Karen Lo)

- 台湾传播

- +886 939788635

- 跳过米勒

- Head Investor Relations Worldwide

- +1 480 235 0934

- Marcel Kemp

- Head Investor Relations Europe

- +31 40 268 6494

- Peter Cheang

- 首席投资者关系亚洲

- +886 3 6596771