We use cookies for a variety of purposes, such as website functionality and helping target our marketing activities. Some functional cookies are required in order to visit this website.

您可以随时撤回您的同意cookie consent page。

Configure your cookie settings and confirm to save your settings. You can withdraw or change your consent at any time on ourcookie consent page。新闻稿 -Veldhoven, the Netherlands, October 16, 2019

今天,ASML Holding N.V.(ASML)发布了其2019年第三季度结果。

Q3 net sales of EUR 3.0 billion, net income of EUR 627 million, gross margin 43.7%

Q3 net bookings of EUR 5.1 billion

ASML expects Q4 2019 net sales of around EUR 3.9 billion and a gross margin between 48% and 49%

ASML修改其资本退货政策,以半年级的方式提供股息支付

| (Figures in milliions of euros unless otherwise indicated) | 2019年第2季度 | 2019年第三季度 |

|---|---|---|

| Net sales | 2,568 | 2,987 |

| 。。。of which Installed Base Management sales1 | 717 | 661 |

| 新的光刻系统销售(单位) | 41 | 52 |

| 售出的光刻系统(单位) | 7 | 5 |

净预订 |

2,828 | 5,111 |

| Gross profit | 1,105 | 1,307 |

| Gross margin (%) | 43.0 | 43.7 |

| Net income | 476 | 627 |

| EPS (basic; in euros) | 1.13 | 1.49 |

| 最终季度现金和现金等效物以及短期投资 | 2,335 | 2,070 |

(1)安装的基础管理销售等于我们的净服务和现场期权销售。

数字已经为读者的便利而四舍五入。美国GAAP合并操作陈述的完整摘要已发布www.porsat.com

CEO statement and outlook

"Our third-quarter sales and the gross margin came in at guidance.

“在今年的剩余时间里,我们希望逻辑能够继续强大,这是由支持最终市场技术和5G和人工智能等应用的领先节点驱动的。内存恢复的时机仍然不确定。万博manbetx官网登录

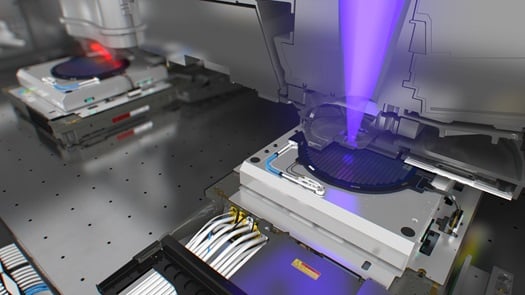

"We continue to make solid progress in EUV. Customers have introduced their first EUV manufactured devices and we have seen EUV mentioned in product announcements. In the third quarter, we shipped seven EUV systems, three of which were NXE:3400C, our higher productivity model. We received 23 EUV orders in the third quarter which contributes to our highest ever value of bookings in one quarter. This strong order flow confirms the adoption of EUV in high volume manufacturing for Logic and Memory.

"Our overall view for 2019 is essentially unchanged as we continue to see 2019 as a growth year," said ASML President and Chief Executive Officer Peter Wennink.

For the fourth quarter of 2019, ASML expects net sales of around EUR 3.9 billion, and a gross margin between 48% and 49%. ASML also expects R&D costs of around EUR 500 million and SG&A costs of around EUR 135 million. Our estimated annualized effective tax rate is around 7% for 2019.

Interim-dividend

ASML宣布已修改其资本退货政策,以半年度提供股息支付。ASML的股息建议将继续受到可分配利润或保留收益和其他因素(例如未来流动性要求)的可用性。

2019年以上的截期股息将为每股1.05欧元。欧元/美元转换的出行日期以及固定日期将于2019年11月4日,记录日期为2019年11月5日。股息将于2019年11月15日支付。

更新共享回购计划

In January 2018, ASML announced its intention to purchase up to EUR 2.5 billion of shares, to be executed within the 2018–2019 time frame. ASML intends to cancel these shares after repurchase, with the exception of up to 2.4 million shares, which will be used to cover employee share plans.

截至2019年9月29日,ASML已根据该计划收购了820万股,总计14亿欧元。ASML不希望在2018-2019的时间范围内购买全部25亿欧元的股票。

In line with our policy to return excess cash to shareholders through growing annualized dividends and regularly timed share buybacks, we will decide on a new share buyback program next year.

当前的程序可以随时暂停,修改或中断。该计划下的所有交易均发布在ASML的网站上(www.porsat.com/en/万博亚洲ios手机客户端investors) on a weekly basis.

Quarterly video interview, investor and media conference call

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the Q3 2019 results. This can be viewed onwww.porsat.com。

A conference call for investors and media will be hosted by CEO Peter Wennink and CFO Roger Dassen on October 16, 2019 at 15:00 Central European Time / 09:00 US Eastern Time. To register for the call and to receive dial-in information, go towww.porsat.com/en/万博亚洲ios手机客户端investors/financial-results/q3-2019。也可以通过收听访问可通过www.porsat.com。

manbext手机官网

ASML是世界领先的芯片制造设备制造商之一。我们的愿景是一个世界上无处不在的半导体技术的世界,并有助于应对社会最艰难的挑战。万博manbetx官网登录我们通过创建产品和服务来为这一目标做出贡献,使芯片制造商定义了集成电路的模式。我们不断提高产品的能力,使客户能够提高价值并降低芯片成本。通过帮助使芯片更便宜,更强大,我们帮助使半导体技术对更大的产品和服务更具吸引力,这反过来又可以在医疗保健,能源,移动性和娱乐等领域取得进展。万博manbetx官网登录ASML是一家跨国公司,在16个国家 /地区的6万博苹果手机客户端0多个城市设有办事处,总部位于荷兰Veldhoven。我们雇用了24,700多名工资和灵活合同(以全职等效表示)。ASML在符号ASML下以Euronext Amsterdam和Nasdaq在EuroNext上进行交易。有关ASML,我们的产品和技术以及manbext手机官网职业机会的更多信息万博manbetx官网登录www.porsat.com。

US GAAP Financial Reporting

ASML的季度收益发行和年度报告的主要会计标准是美国GAAP,这是美国普遍接受的会计原则。美国GAAP的季度合并运营陈述,现金流量的合并声明和合并资产负债表可在www.porsat.com上找到。

The consolidated balance sheets of ASML Holding N.V. as of September 29, 2019, the related consolidated statements of operations and consolidated statements of cash flows for the quarter and nine months ended September 29, 2019 as presented in this press release are unaudited.

Regulated Information

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

前瞻性语句

本文件包含前瞻性陈述,包括有关预期趋势,前景,预订,财务业绩和有效税率的陈述,2020年和2025年的年收入机会以及增长机会,最终市场,产品和细分市场的预期趋势, including memory and logic, expected industry and business environment trends, the expected continuation of Moore’s law and the expectation that EUV will continue to enable Moore’s law and drive long term value for ASML and statements with respect to plans regarding dividends and share buybacks, including the intention to continue to return excess cash to shareholders through a combination of share buybacks and growing annualized dividends and the expected interim dividend and plan to pay any dividend on a semi-annual basis and intention to decide on a new share buyback program in 2020. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue", "target", and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve risks and uncertainties. These risks and uncertainties include, without limitation, economic conditions; product demand and semiconductor equipment industry capacity; worldwide demand and manufacturing capacity utilization for semiconductors; the impact of general economic conditions on consumer confidence and demand for our customers’ products; performance of our systems, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products; the number and timing of systems ordered, shipped and recognized in revenue, and the risk of order cancellation or push out, production capacity for our systems including delays in system production; our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation; availability of raw materials, critical manufacturing equipment and qualified employees; trade environment; changes in exchange and tax rates; available liquidity, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, results of the share repurchase programs and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Contact information

- Monique Mols

- 媒体关系主管

- +31 652 844 418

- 桑德·霍夫曼

- Media relations manager

- +31 6 2381 0214

- Brittney Wolff Zatezalo

- 企业传播经理美国

- +14084833207

- Skip Miller

- 全世界的首席投资者关系

- +1 480 235 0934

- 马塞尔·肯普

- Head Investor Relations Europe

- +31 40 268 6494

- 彼得·齐格(Peter Cheang)

- 首席投资者关系亚洲

- +886 3 6596771